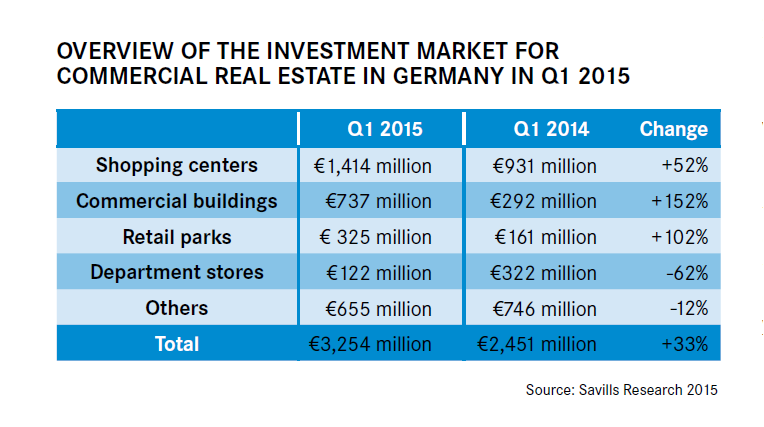

The German investment market for commercial real estate was very dynamic at the beginning of the year. In total, €3.2 billion of objects changed owners, a growth in turnover of one third when compared to the same quarter last year. At nearly €1.8 billion, portfolio transactions accounted for slightly more than half of this volume.

The largest transaction by far in the first quarter was Klépierre’s acquisition of Corio, whereby five German shopping centers worth about €1.1 billion were transferred to the French real estate company. This transaction accounted for about 80% of the shopping center transaction volume of approximately €1.4 billion (+52% compared to Q1 2014). The segment with the second highest turnover was commercial buildings into which nearly €740 million flowed, 150% more than in the same quarter last year. In third place were retail parks, the transaction volume for which more than doubled to €320 million.

“Retail parks have recently become significantly more popular with investors and have gained ground on shopping centers,” explains Jörg Krechky, Director and Head of Retail Investment Germany at Savills, adding: “The buying factors are lower than for shopping centers, the management is less complex, and retail parks are not exposed to the same degree of competition from e-commerce thanks to their local supply function.”

Against this background, it can be assumed that retail parks will become even more prominent in investors’ attention in the future and that the transaction volume in this segment will continue to rise.

EXPANDED SEARCH PROFILES

In general, the increase in transaction volumes is mainly due to the fact that investors have expanded their search profiles. “In recent years, most investors were focused on core products and thus on established shopping centers and commercial buildings,” says Andreas Wende, COO and Head of Investment Germany at Savills. “Investors are now much more willing to switch to the core plus or value-added segment. This has given the retail investment market a new impetus because the choice of proper-ties in this risk category is much greater,” he adds.

Due to the Corio acquisition, property companies/REITs were the largest group of buyers in the first three months of this year, with a purchase volume of more than €1.3 billion. Far behind in second and third place were special funds (about €360 million) and other asset managers (about €350 million). Their financiers increasingly come from abroad, not least from Asia.

“It is still very rare for Asian investors to get involved directly. This is mostly due to a lack of the necessary know-how and local presence,” says Matthias Pink, Director and Head of Research Germany at Savills, explaining why Asian retail investors in Germany have so far invested almost exclusively via fund managers. Because interest from other regions of the world is increasing, especially from the UK and the US, which in the first quarter directly invested nearly €500 million, sustained high transaction volumes are expected for the remainder of the year. The transaction volume for the previous year in the amount of about €8.9 billion will therefore most likely be surpassed this year.