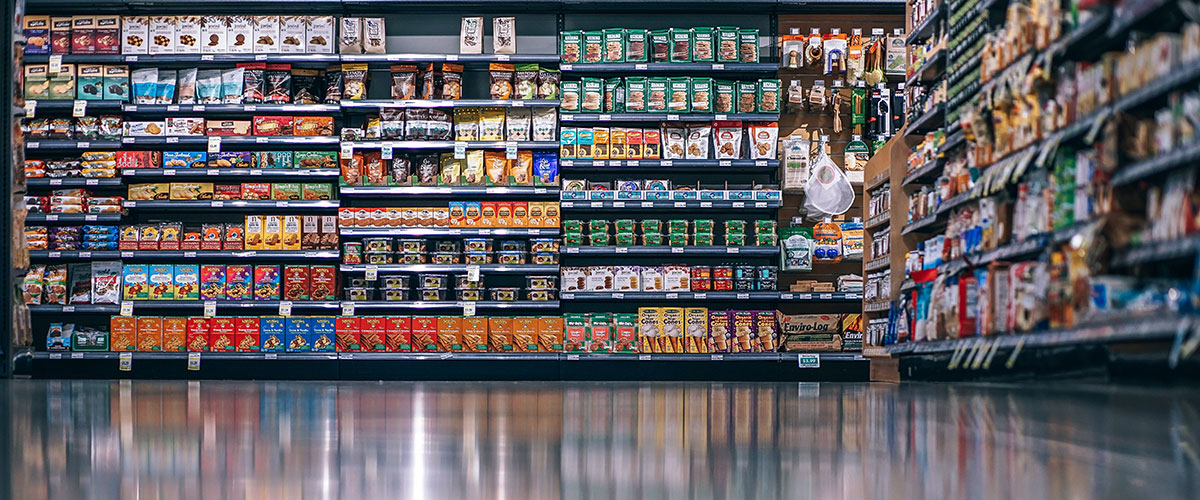

The European grocery real estate market has remained resilient in the face of economic uncertainty, as the Covid-19 pandemic has provided new opportunities for growth and has increased investor appetite. According to “The European Grocery Real Estate Market”, a new report by Union Investment and JLL, the grocery real estate market, which attracted €6.7 bn of the capital flows targeting retail real estate in 2020, is set to continue to flourish throughout 2021.The report findings show that real estate investors have historically under-allocated capital towards grocery real estate assets, accounting for only 10% of Europe’s overall retail investment volumes, on average, between 2014 and 2020. In comparison, grocery stores attracted 37% of the total retail consumption in the EU (27 countries) in 2020.

The resilience of the sector during the pandemic has led to net initial yields for quality grocery stock in Europe’s key retail markets continuing to see compression, demonstrating increased investor appetite.

Grocery-anchored Real Estate as Stable Investment Objects

Although there is still uncertainty concerning the long-term implications of the pandemic, the report seeks to identify longer-term trends that will affect the grocery real estate market.

Firstly, despite growth in online food sales throughout the pandemic, this rate of growth post pandemic is expected to slow down. We see retailers embracing both online and brick-and-mortar retail opportunities: Low profit margins will not sustain widespread online sales, and retailers continue to invest in their physical stores, enhancing the shopping experience and, in some cases, using physical stores as distribution hubs for online sales.

Secondly, grocery-anchored real estate investment has shown itself to be one of the most resilient parts of the retail investment environment: The recent performance of food retailers compared to, for example, fashion, and the strength of grocer covenants has reinforced the attractiveness of the grocery-anchored real estate sector throughout the pandemic. The sector is able to offer both core long-term income for more risk-averse investors as well as more value-added products where shorter leases and older assets are active in the market.

Thirdly, investor interest in supermarkets and grocery-anchored real estate is on the rise: The average grocery investment in Europe has been reasonably consistent year on year at approximately €4.5 bn annually over the last six years, but it grew by over 40% to approximately €6.7 bn in 2020 compared to 2019.

Urbanization Provides New Sales Opportunities

Fourthly, growing urban populations are set to create opportunities for well-connected grocery stores: Despite the pandemic, employment opportunities and social considerations will continue to drive migration to cities, with urban populations across Europe expected to rise 3.4% by 2035 (3.7% including the UK). That means that well-connected grocery stores within growing conurbations will be able to attract new customers and offset periods of weak GDP growth. Developers are also increasingly looking to transform some larger stand-alone sites into urban logistics hubs. Among the key grocery markets, urban population growth by 2035 is forecast to be the strongest in Sweden (+14.7%), the Netherlands (+8.4%), and France (+8.3%).

Fifthly, changes in customer preferences will be the key drivers of grocery consumption, with sustainability, affordability, and quality leading the charge: The overall revenue growth of the grocery sector is heavily tied to consumers’ purchasing power and, therefore, a change in customer preferences will require continual assessment of current store portfolios. Changing shopping preferences driven by demographics, changing work patterns, technology, and sustainability will all be key drivers for floor productivity for the various grocery store formats. Adaptability will be key for the grocery sector in terms of being able to quickly pivot in response to these changing preferences.

Mike Bellhouse, Director, Head of Retail Investment, International Capital Markets at JLL, said: “The European grocery real estate market is proving itself to be a secure and defensive sub-sector within the wider retail investment market. Over the years, it has been among the most stable commercial real estate asset classes in Europe in terms of pricing. Despite an uncertain economic environment and pressure from online retail, well-located food stores remain an irreplaceable part of the food distribution process and the European grocery real estate sector continues to attract investors looking for longer and more secure income streams.”

Henrike Waldburg, Head of Investment Management Global at Union Investment and Member of the ACROSS Advisory Board, added: “Despite a sharp rise in demand for home deliveries, physical stores continue to fulfil an irreplaceable role in the food distribution process, supporting both in-store and online grocery sales. While many grocery retailers have increased their investments in the strengthening of their online capabilities and infrastructure, growing conurbations are set to increase demand for physical stores in urban areas, which will offset shifts in retail spending.”

The “The European Grocery Real Estate Market” report can be found at https://ui-link.de/groceryreport.